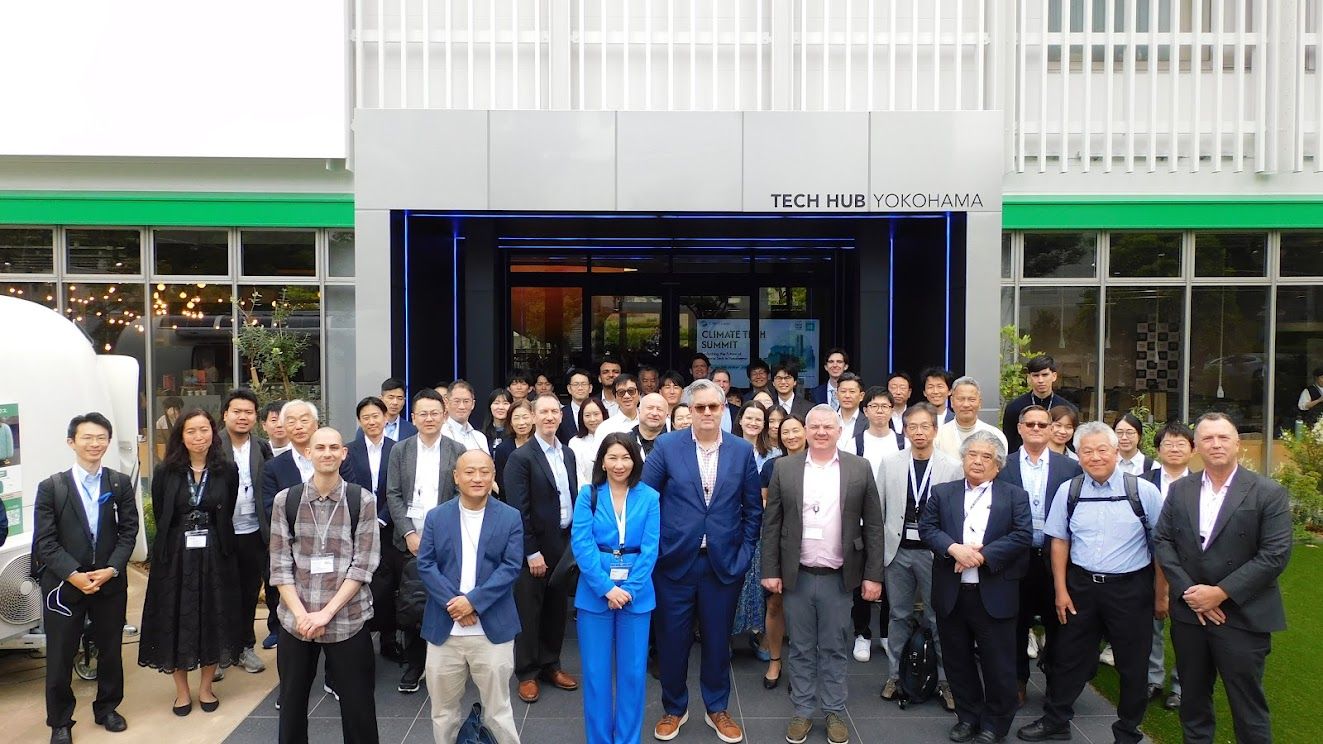

On May 26, 2025, CleanLeap, based in Silicon Valley and a supporter of climate-tech startups across the United States, hosted the CleanLeap Climate Tech Summit at TECH HUB YOKOHAMA. A total of 54 attendees from Japan and the U.S., including U.S. climate-tech venture capitalists, startups, investors, and policy stakeholders, gathered to discuss the latest trends in clean technology, explore opportunities for international cooperation, and hear pitches from Yokohama-based companies.

Overview of Participating U.S. VC Mission

Nine investors from U.S.-based venture capital and investment funds that support climate-tech and sustainability startups worldwide participated in the event:

-

Enrichers (California): Enrichers is an AI-driven collaborative R&I community management platform dedicated to supporting soft-landing and scaling-up programs for global deep tech startups, particularly in the healthtech and cleantech sectors (in partnership with CleanLeap). Programs are designed to support 1) education & connection 2) market validation 3) university incubation. Enrichers works closely with EIC EU Sovereign Fund and CDTI Spanish Sovereign Fund. actively expanding our global partnerships with government agencies and sovereign funds to enhance cross-border innovation and facilitate the entry of high-potential startups into the U.S. and in Europe.

-

Skjander (U.S. & Australia): At Skjander, we source and manage real, impactful and measurable biodiversity and environmental protection on behalf of clients. We connect global companies seeking credible, positive environmental impacts to projects that are meaningful, reportable and traceable, in line with international reporting frameworks like TNFD and ISSB.

-

IDGB Capital (New Jersey): IDGB Capital drives significant benefits and value to its business partners by engaging in the promotion of innovative solutions that are capable of becoming sector leaders. We effectively accomplish that by leveraging our industry and transactional expertise as well as our global network of close relationships.

-

United Re (New Jersey):United re is a reinsurance facilitator of traditional reinsurance and reinsurance structured solutions targeting life, property & casualty insurance across Israel, Central and South America, Eastern and Western Europe.

-

TechNexus Venture Collaborative (Chicago, Illinois): TechNexus helps leading corporations and ambitious entrepreneurs develop mutually beneficial relationships that accelerate growth opportunities. A first-of-its-kind Venture Collaborative, we invest capital, incubate, and collaborate to create new growth opportunities. For over a decade, TechNexus has initiated hundreds of positive outcomes between mature corporations and early-stage companies to create new business models, revenue streams, and products.

-

Unovis Asset Management (New York): A specialized fund dedicated to transforming the global food system through sustainable protein alternatives. Investing early in plant-based and cell-cultivated protein technologies, targeting global environmental, health, food security, and animal welfare impacts.

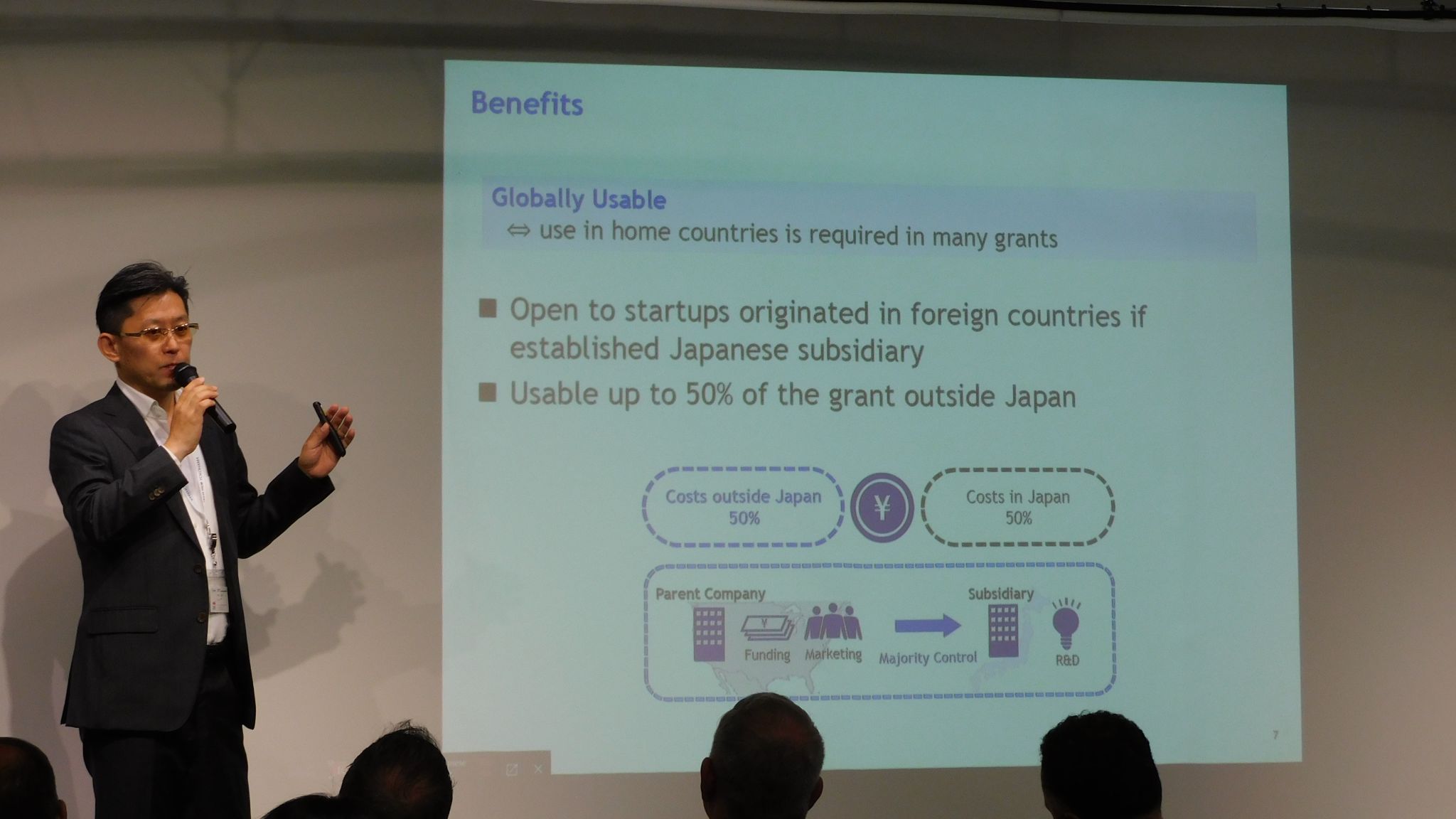

The CleanLeap event began with a welcome address from the Innovation Promotion Division of the Yokohama City government. This was followed by an introduction to Yokohama’s startup ecosystem, featuring The Drivery Japan, and a briefing on the city’s climate and environmental policies. The National Institute of Energy and Industrial Technology Development Organization (NEDO) then introduced Japan’s deep-tech support landscape, including initiatives that are also available to international startups.

In this special session, Porter Wong, Founder and Executive Director of CleanLeap, appeared in conversation with Nikolai Muth, Project Manager at the Office of the City of Yokohama Representative to the Americas. Porter outlined CleanLeap’s mission and vision, including its nonprofit model supporting startups from inception to exit, as well as stage-specific acceleration programs in North America and Europe. For Japanese companies, he highlighted resources such as legal advisory services, company formation online classes, global pitch opportunities, and grant programs.

During the second half of the session, Porter discussed current trends in U.S. climate-tech policy and investment markets, noting that Japan’s ESG investment market is growing faster than other regions, renewable energy investment in the U.S. continues across political lines, and that regional regulatory differences are shaping new strategies for ecosystem partnerships.

This session included presentations and a panel discussion on climate-tech investment trends in the U.S. and Japan. The Climate Tech Japan cofounder presented insights into Japan’s investment landscape, CVC activity, and startup environment. This was followed by a presentation from TechNexus on U.S. climate-tech investment trends and the role of accelerators.

A fireside-chat moderated by Shannon Theobald (CleanLeap Investor Relations) featured panelists Sebastien Torre (Enrichers), Umer Sadiq (Climate Tech Japan), Ryuichi Iwata (JERA Ventures), and Karel Nolles (Skjander). The session covered two major themes:

-

Regional investment and innovation strategies:

Australia favors government-backed environmental credits; Japan emphasizes policy-driven and large-corporate-backed deep-tech investment; the U.S. excels at scale-up execution; and Europe excels in early-stage R&D but lags in later-stage funding. Cross-border collaboration was highlighted as vital. -

Regulation, risk tolerance, and cultural differences:

Business cultures differ: Japan places emphasis on trust-building and deliberation, the U.S. prefers fast intent signaling, and Europe leans on institutional bridges such as universities. Long-term “nature investments” around biodiversity agreements were identified as promising for future market growth.

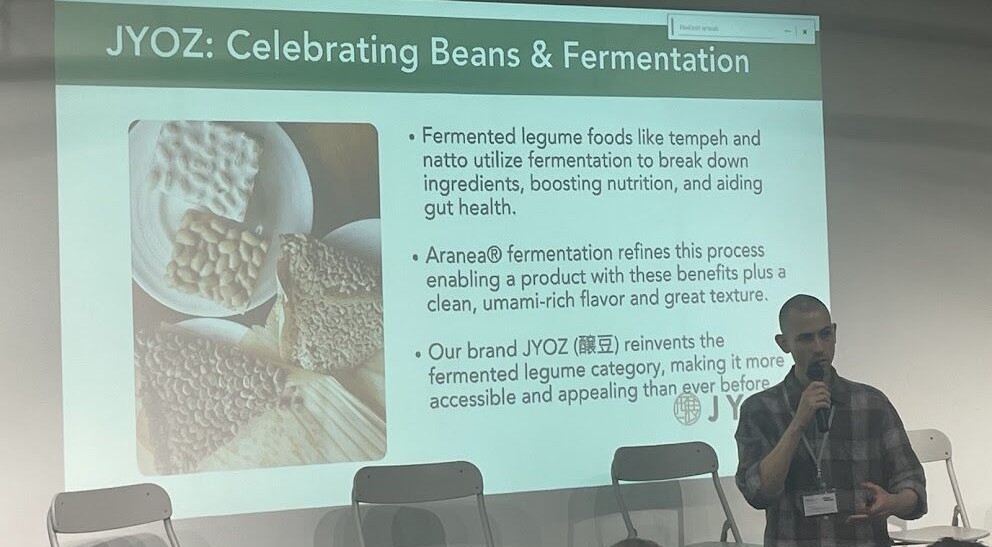

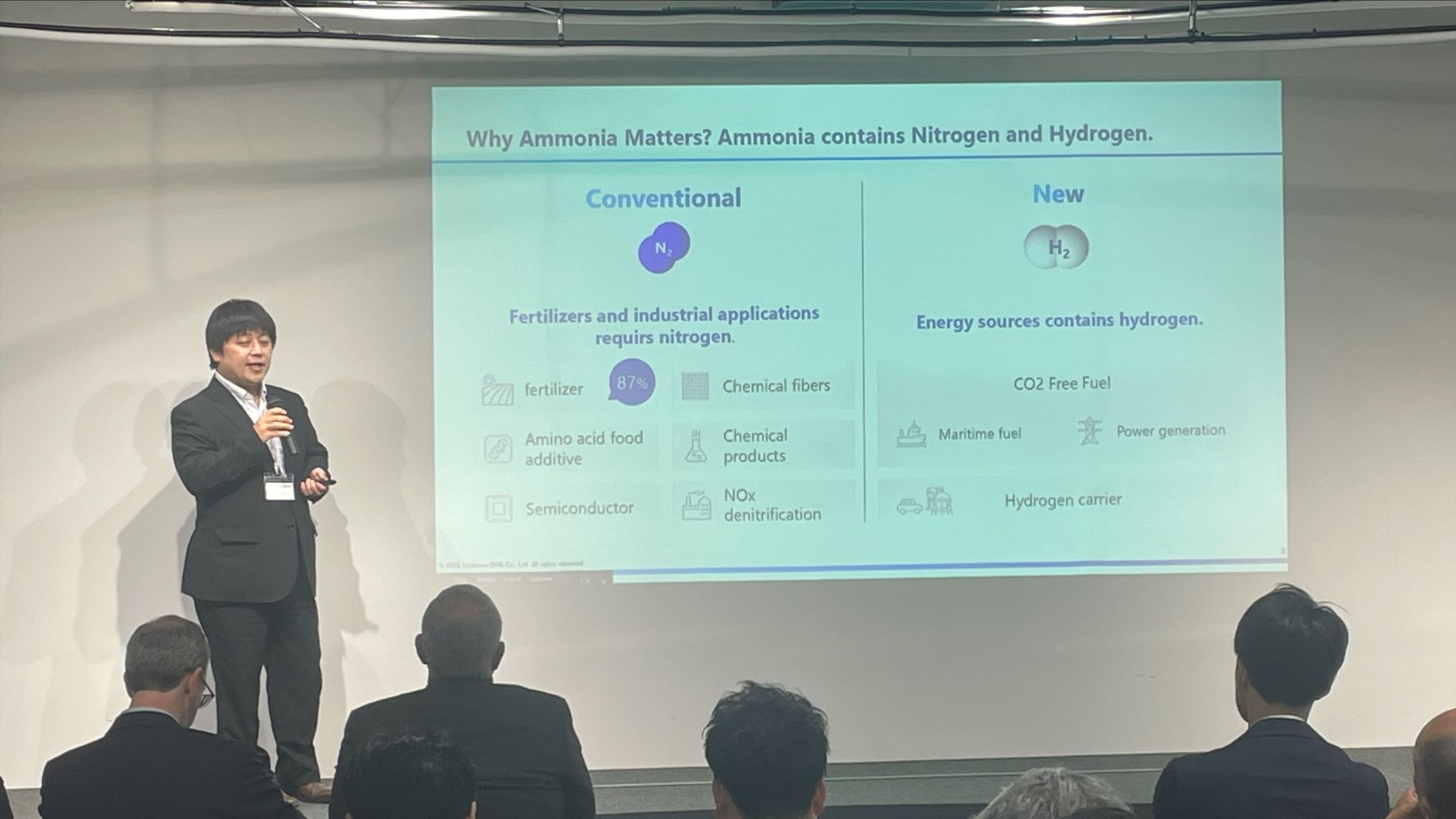

In the afternoon, three Yokohama-based startups—Hakko Holdings, SUN METALON, and Tsubame BHB—presented their climate-tech solutions. Their pitches drew rich feedback from the international VC audience and sparked discussion on market fit, technical feasibility, and global scaling.

The final panel, titled “Circular Economy Connected by Nature and Technology,” was moderated by CleanLeap Advisory Board member for the Los Angeles region, Sen Tan. Panelists included Dan Altschuler (Unovis), Tokuro Hatori (TBM), and Takashi Kawai (United Silk Company). Their discussion focused on two key insights:

-

The importance of collaborating with existing supply chains, regulators, and end customers during scale-up efforts to ensure product integration and market adoption, especially for circular and food-tech solutions.

-

An evolving investor focus shifting from climate and plastic toward carbon capture and reuse, with greater openness to ESG-minded startups.

This session underscored the potential of nature-based innovation to support a circular economy through practical, collaborative approaches.

Throughout the lunch break and after the event, participants engaged in meaningful networking, exchanging ideas and identifying new avenues of U.S.–Japan collaboration.

Supported by the City of Yokohama, the summit was initiated through a connection first established between CleanLeap and the Office of the City of Yokohama Representative to the Americas at the VERGE global climate-tech conference. It now serves as a stepping stone toward strengthening Yokohama’s ties with North American and broader global climate-tech ecosystems. The city remains committed to supporting international expansion of local companies and contributing to a sustainable future through strategic global partnerships.